Hygiene wages are often set to equal a third of hygiene production. This benchmark, cited frequently in the dental industry, is a yardstick for salary discussions. What happens when the practice contracts with a number of PPO plans that pay below average for hygiene services? Is it still fair to use a below average reimbursement model when determining fair hygiene wages?

After all, the hygienist did not sign up for these plans! New features in practice management software programs post the PPO fees to the ledger, making it arduous to back out of those adjustments to realize the true hourly production based on full office fees. What if there was another option?

Most PPO contracts expire in 18 to 24 months. The contracts automatically renew; however, the opportunity for renegotiating a contract is sometimes not obvious. Staying on top of renegotiating contracts only makes sense.

While contract negotiations are not typically a role that the hygienist takes on, I did just that. I wanted to swing the “you should earn one-third of your production” dialogue in my favor, and I wanted to help the practice.

It took four months of polite persistence. I emailed retention specialists every few weeks when I did not hear back from them and eventually successfully renegotiated several contracts. I accepted the fact that some contracts are non-negotiable and cut my losses on those.

Even if you are not in the position of renegotiating, share this article with your front office manager or doctor. Missing a renegotiation opportunity hurts the business, the patients, and the staff.

Identify the Plans

Identify the plans you are currently participating with and the dates that renegotiations are available. This will be in each contract. I found it easier to put the contracts in a 3-ring binder with the date of contract expirations as well as the name and email of the retention specialist for each plan. In another 18 to 24 months, this task will be easier.

Calculate the Number of Patients on Each Plan

Calculate the number patients on each plan to help make better decisions. A low reimbursing plan with few patients is definitely an easier decision than a low reimbursing plan with a large number of patients participating. Start with the plans with few patients participating to get the feel for the negotiation process. I found it less intimidating to negotiate with a plan that only represented 2% of our patient base vs. a plan that represented over 50% of our patient base. It gave me an opportunity to learn the ropes regarding the process.

I initially learned I needed to make sure I was speaking to the correct person who has the ability to negotiate. I also learned I needed to include the physical address of the practice, doctor’s legal name as listed on the contract, and tax identification number in all correspondence. By the time I started negotiating with our more impactful plans, I at least sounded like I knew what I was doing!

Map the Contracts

Map the contracts to get a big picture of network share arrangements. It is common for insurance companies to lease their fee schedules to other carriers. If the doctor did not opt out of this arrangement, they are automatically opted in. It is a little sneaky, but that is another article. In the case of Delta, when you sign up for one state – such as Delta of Washington – you are automatically agreeing to Delta of every other state. Other carriers do the same thing.

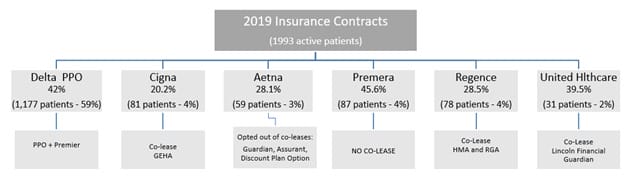

Creating an overview or “map” in the form of a diagram helps keep leasing arrangements visible for the practice. Your overview should include all carriers in your network, in addition to the exposure you have with co-leased plans under each carrier. The diagram below shows how I mapped out our plans. This helped me know the primary contract as well as the co-leased contracts.

I also included the number of patients on each plan and the percentage of the practice that each plan represents. In the diagram below, you can see we have 1,177 patients on a Delta plan. This represents 59% of our total patient base. The percentage listed directly below each carrier represents the average write off required to be on the plan. In the case of Delta, we write off 42% on average for every Delta patient!

Call Each Insurance Carrier to Get the Name of the Retention Specialist

This was harder than I initially thought it would be. I called the 1-800 number and reached a customer service representative. I explained I needed to speak to someone regarding our contract that could help me renegotiate fees. In some cases, I was transferred to another number only to be disconnected. In other cases, I was transferred to a recruiter that didn’t have the authority to renegotiate existing contracts. Recruiters only negotiate new contracts.

I was also assigned a ticket from some carriers who promised a fee review in 90 days. That is where polite persistence comes in. Set a tickler in Outlook and plan to touch base again in 90 days. My greatest takeaway was a renewed respect for the run-around our front office staff goes through when reaching out to insurance carriers. I was placed on hold so many times, and for so long, I had to hang up in order to see a scheduled patient, which prompted starting the task again the next day! In all honesty, getting in touch with the right person was probably the longest part of the process.

Review Office Fees

You will submit your office fees during negotiations. Well-positioned fees help you in many ways, not just for PPO negotiations. In this case, healthy office fees provide better negotiation advantage.

Aim for the 80th percentile for your zip code. You can check these through several services including the National Data Advisory Service (NDAS), the ADA, or through fairhealthconsumer.org. The Fair Health Consumer site is not for commercial purposes, allowing you to check just 20 codes at a time.

Increase office fees annually, even if you are not in a negotiation process. Increasing office fees annually stabilizes business overhead. I ordered the NDAS software, and we adjusted our current fees, which were in the 72nd percentile, to the 80th percentile.

Calculate the Write-off Percentage for Each Plan

This involves looking at your procedure code report for frequency of services. Generate an Excel spreadsheet to compare each plan’s reimbursed fees to your office fees multiplied by your frequency of use. This is an important step.

If you have a high reimbursement for veneers, but only do three veneers per year, the impact is small. A high reimbursement for a prophy or x-ray code is much more impactful. During negotiations, you may have an opportunity to create a custom fee schedule. Select the codes frequently used that provide the highest production to the practice, such as a prophy code, for the custom fee schedule. This evaluation will provide an average adjustment percentage you are taking for each plan.

Now the negotiations can begin! Cut your losses on the plans that are not open to negotiation. Move to the plans that are open for negotiation and contact the co-leased companies to get an offer.

In some cases, you can get a higher fee from a company that is co-leasing with another plan. In other cases, it is worth contracting directly with the co-leased option and dropping the plan. It is all a numbers game. I was able to renegotiate four of our plans gaining anywhere from a 2% to a 12% fee schedule increase. We dropped a smaller plan and negotiated directly with a carrier that was co-leasing the fee schedule for a more favorable contract.

In the end, the dialogue shifted. The plans paid at a higher level and my wages were not tied to just a production number. After all, a great deal of the hygienist’s value comes from less tangible data:

- The ability to build relationships and loyalty with the patient base.

- Added referrals.

- The knack for understanding what patients want and when they are ready to proceed.

- The ability to reinforce recommendations from the dentist.

- The education provided to patients and reinforcement of good oral health habits.

- The partnership that develops when treating periodontal disease.

Doctors will continue to tie hygiene wages to a percentage of their production. Perhaps the rebuttal question for the doctor is, “When did you last renegotiate your PPO contracted fees?”