When I was a kid, my dad would tell me on the way to the dentist to be prepared to pay out of my own pocket for any cavities I had. $38 per filling was an insane amount of money for an eight-year-old with a 75 cent allowance per week and 7-Eleven candy habit. I hedged my bets that his threats were empty, that I’d get my dental care and never have to pay up.

And it worked. Since I didn’t have a proper income, my parents went ahead and took care of the bills for me, got me to the dentist, fixed those cavities right up. Instead of making me pay in cash, however, I paid up in guilt, for not taking care of my teeth as I should have.

I carried that guilt for years, right into college and ultimately into dental hygiene school, when I learned something interesting about the type of fillings that were in my teeth: if I’d had sealants as a child, there would have existed the possibility for me to grow up cavity-free. But sealants weren’t widely available to dentists until the mid-1980s, too late to save me from the drill.

That’s the thing, though. Dental practice is not malpractice if it’s within the current standards of care, so my dentist growing up was in no way neglectful of my dental health. It’s just the way things were then. I have a bunch of pits and fissures in my back teeth full of silver instead of smooth white sealants like my kids do – all those deep grooves they inherited from me were sealed just as soon as their permanent teeth came in.

Dentists and hygienists have a belief ingrained in us throughout our education: The best dentistry is NO dentistry because natural healthy teeth will almost always be better than man-made teeth. We are driven to help you keep your teeth in their most natural state as possible, for your entire life. We can’t do this, though, unless you visit us for preventive care. Our experience and training let us see the earliest signs of things that aren’t quite right in your mouth so that we can help you take the necessary steps to correct them way before they become disfiguring, painful, or expensive.

This might be a good time then to start talking about dental insurance. Before we do that, though, let’s explore more generally. What is insurance? It’s money you pay to someone else to take care of things if the unexpected happens.

If you’re fortunate enough to never have a house fire, or die, or crash your car, there’s nothing that your insurance policies need to cover, so you’ll never get a reimbursement check. Medical insurance used to be a reimbursement system, too, until insurance companies had to come up with clever ways not to cover people’s health problems so that the insurers wouldn’t run out of money. Hospitals and doctors also became clever with their billing, and this back and forth game of “how can we make the money flow in our direction” has resulted in our current health care situation.

This cleverness has also invaded dentistry. Here are three truths that exist right now:

- A lot of people have crappy dental plans

- They go to dentists they don’t trust and

- Get treatment they don’t need.

Do you want to help me change these three truths? You can, you know. We’ve done it before, you and I. You helped me get the word out that plastic in toothpaste was a bad idea, and we got that banned in the United States shortly afterward. This is so much bigger: helping each American keep their teeth for life, at a cost they can afford.

To do this, we’re going to have to get everyone working together, but differently. You can’t change the system by just saying it needs to be changed and then doing nothing from your place within it. There’s also no ability to change if you don’t understand how to make a difference with your own actions. Right now, inadequate dental insurance is the standard of care, sort of like silver fillings were in the ’70s. Are you ready to help me move dentistry another big step forward?

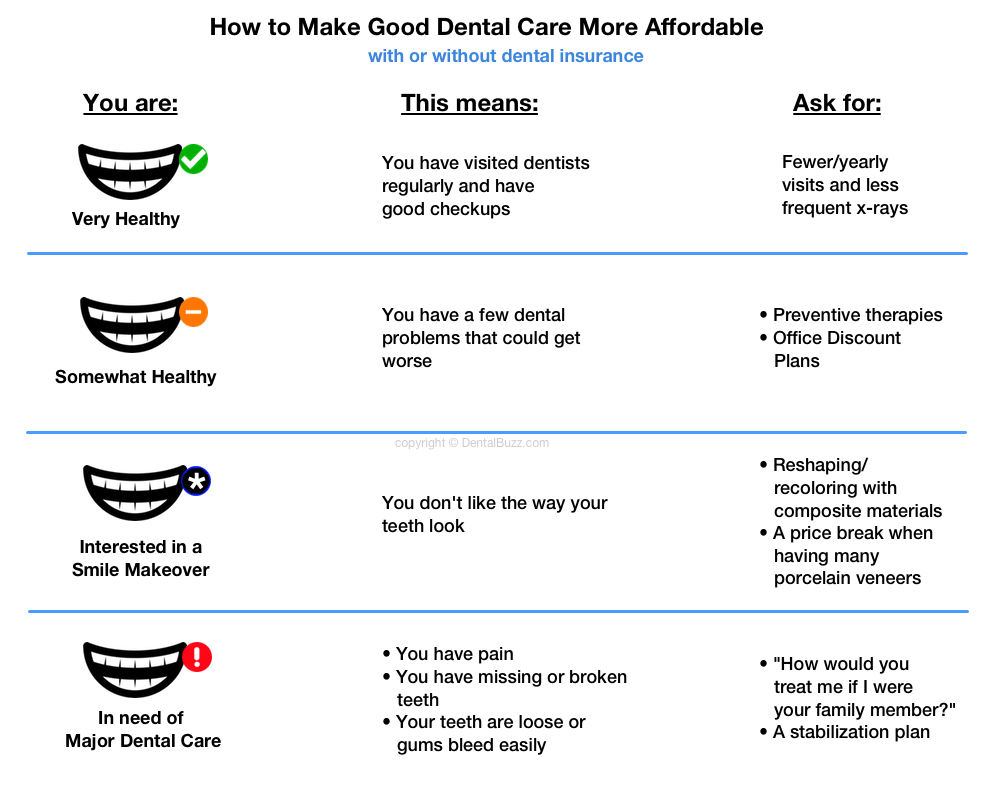

Look at yourself in the mirror.

This is where it starts. With you. What do your teeth mean to you? Are their appearance important, or is it good enough that they don’t hurt and you can chew with them? Take a hard look at your teeth, and answer these two questions honestly to yourself.

Believe it or not, dentists spend a lot of time trying to guess people’s values. If you don’t know how you feel about your own teeth, then how does your dentist decide what’s right for you?

Natural teeth are going to be everyone’s first and best option. You get the first two sets of teeth for free – they’re given to you, as part of your body. If you’re fortunate enough to have parents who were able to take you for early dental care, who reminded you to brush your teeth regularly, who did their best to manage your habits and your diet, then you are less likely to need a third set of teeth. Without getting into details, let’s agree that anything dentist-made in your mouth, which takes the place of natural teeth, is part of the “third set.”

That dentist-made stuff, though, is the set of teeth that ends up costing a lot of money. Fixing teeth is how dentists stay in business, after all. But it’s also where insurance breaks down, on that third set of teeth. Even the best plans only cover, at most, the dollar equivalent of about two dentist-made teeth per year. If you have 28 teeth, that means you’ll have to use up all your benefits, every year for 14 years to get your third set of teeth paid for. If your insurance only pays for two teeth per year, but you have 10 teeth that are in trouble, what do you do, only treat a few and let the others all rot while you’re waiting on your insurance checks?

Something else you need to admit to yourself is to make the realization that you’re not immune to the lure of the bargain. Too often, that’s all dental insurance is. It’s sold to you as a bargain, or something that you have to have to get in the game, when the reality is that it’s only a game.

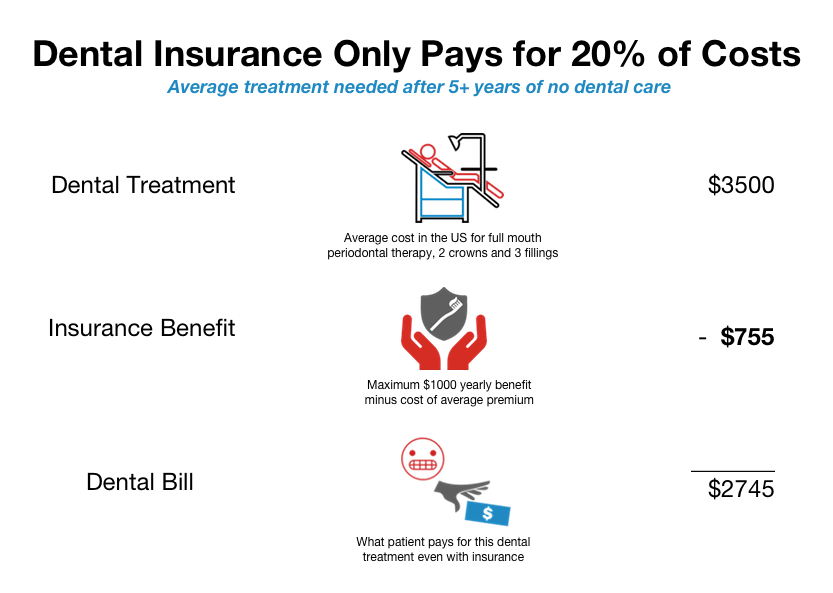

Take this example:

Yep, that insurance made a $755 dent, which is big. But at what cost? Were the fillings and crowns built to last, or will they need to be replaced in less than five years since you felt you had no other dentist who would take your insurance and the one that you did go to didn’t seem to do that great of a job?

Let’s back up now and talk about your first two sets of teeth. You get the baby set as a toddler, the other set as you grow up. Both of those sets of teeth don’t cost anything; they just sort of show up one day, ready to get to work. And they need a dentist to check in with them every so often, to say hey, howya doin? Everything all right in there?

That’s what most people think of as a check-up, and if you’ve had good luck with your teeth so far, it’s safe to say that having at least one dental visit per year will assure that someone’s keeping a professional watch on them.

Checkups are cheap.

Can you afford $50 per year? That’s the current average cost for a routine dental checkup in the US, across all dentists – city dentists, rural dentists, group dentists, solo dentists.

If dental checkups are not crazy expensive, then why isn’t this common knowledge?

Have you assumed that basic checkups cost more than $50? If you have, you’re like most people. It’s probably why you’ve been worried about the cost of going to the dentist, why you’ve been worried about not having insurance, why you make sure that the dentist you choose takes your plan, why you visit low-cost clinics. You haven’t known the cost of the alternative.

This knowledge is your power. You can go to any dentist, and $50 is the average price for a periodic examination – this what they will charge to take a look at your mouth during a routine visit. It’s a little more for your first time, say $75-$100. A series of four bitewing X-rays? Usually less than $60. Certainly not free, but altogether not as much as you may have imagined.

So let’s bring insurance into our discussion once again. Remember, insurance, for everything except your body, pays nothing until there’s an unexpected event. A dental checkup is not unexpected – it’s prevention! And if you’ve ever worked with dental insurance, you know this: Almost every dental insurance policy completely covers the cost of a checkup. But they don’t do so universally. With many of those checkups, your insurance will only cover the cost if you visit certain dentists.

Dental insurance pretends to pay for your teeth.

If it really paid for them, like insurance is designed to do, it would cover the unexpected problems, especially in emergency situations. Instead, dental insurance gives you just enough coverage to make you feel like it’s a value and scares you into thinking you can’t go to the dentist without it. Most plans offer a fixed dollar amount, around $1000, to use per year, and that’s it. If repairing your teeth costs significantly more than your maximum, it’s not protecting you. Dental insurance shouldn’t even be called insurance, because it works more like a dollar-off coupon. $1000 off of a $6000 treatment plan is at best only a 17% discount. Call yourself a sucker if you tolerated care at your “in-network dentist” so that you could get less than 20% off the cost of going to a dentist of your choosing.

Dental insurance changes how dentists care for you.

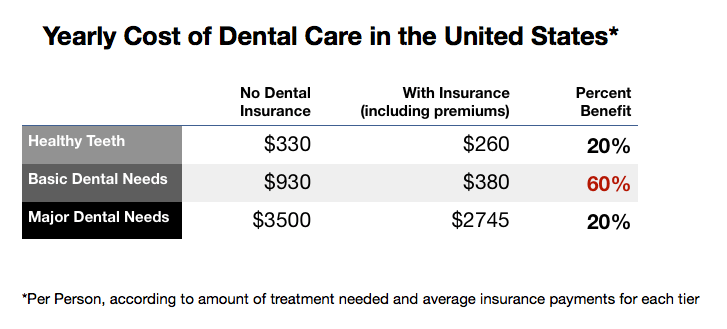

We have been conditioned to believe that a procedure must be the right thing to do because “insurance will pay for it.” There is a sweet spot, right in the middle of insurance plans that covers so much more of a percentage of the total cost than either end. People with healthy teeth get basically a 20% discount for the cost of their care after taking premiums into consideration. It’s also 20% off of the cost of really expensive needs like crowns and dentures. But look how the dental benefit skews within the middle tier of dental needs:

Whoa! It jumps up to 60%. This can go one of two ways:

- There are a few things you really need to have done, and insurance will help out a lot!

- Your insurance will get billed for stuff you don’t need because you won’t have to pay for it yourself.

This doesn’t bother me all that much for preventive care because it’s not permanent and mostly reversible. But when dental offices intentionally “massage the insurance” to abuse this 60% sweet spot, a dentist might take a drill to a tooth that didn’t really need it, and guess what? You’re damaged. You’ve actually been broken by someone you trusted to take care of you. They took out a piece of your tooth, forever, and you can never grow it back.

Destroying healthy tooth enamel for profit makes me angry.

I’ve seen this dressed up at dental practices to make it sound like they have patient’s interests in mind. It might be called “their philosophy of care,” but really, you’d be surprised how many people exist whose paychecks are dependent upon exploiting insurance codes to get the most money for their practices. “Maximizing fee schedules” is their philosophy of care. And you are a pawn to them. This is the essence of why dental insurance makes good people do bad things.

Exploiting Insurance Codes for Maximum Dollars.

Let’s blow this up a little and list some of the ways that insurance is abused. You may want to be on alert when you see these on your treatment plan or billing statement:

Core Buildups. This article from the American Association of Dental Consultants states, “In the last twenty years there have been a reported increase in the number of core buildups submitted to dental benefit plans out of proportion to the increase in crown submissions… Also growing are the numbers of dentists who admit, with no compunction, that they place core buildups under every crown they seat regardless of need. The financial ramifications from this trend are significant since a core buildup can add twenty to thirty percent to the final cost of a crown.”

Periodontal scaling and root planing. Often called a “deep cleaning,” gum disease treatment is the primary weapon against tooth loss, but it is a time-intensive procedure. If an office charges out periodontal therapy but you weren’t even numbed, or it took less than an hour to have treatment in all four sections of your mouth, that’s a reason for your eyebrows to go up. Also, be cautious of any dental office where your routine cleaning appointments seem super-speedy, according to this article, or if you’ve always been healthy like this person.

The need for many fillings suddenly. You’ve been off and on with regular dental care, and have had few fillings in your life. Then you visit a new dentist and are told that you have a lot of cavities. According to this article from the New York Times, some doctors may wait longer than others and “watch” small cavities, but if you feel suspicious, you should definitely seek a second opinion before the drilling starts. One pediatric dentist’s editorial on the ADA website goes so far as to call this “creative diagnosis.”

Replacement of silver fillings. Sure, they don’t last forever. But silver fillings do typically last longer than tooth-colored fillings, and if there is no pain or an obvious hole or cavity in a tooth with one, most dentists won’t try to scare you into changing them out, especially not all at once. The National Council Against Health Fraud issued this statement defending amalgams. I personally have six silver fillings that are around 40 years old, and they all still feel better than the two that were replaced.

Procedure Upselling. Any time a dental practice uses intimidation to get you to agree to something, that’s wrong, regardless of whether or not the treatment is appropriate or covered by insurance. Don’t ever feel pressured, especially if you’re in a vulnerable position, to agree to whitening, bite guards, cancer screenings, or even orthodontic care. A reputable dentist will let you take your time to make decisions about your mouth.

Suspicious dates or billing. Look over these examples of fraudulent and abusive practices; these may be signs that a practice is illegally obtaining insurance benefits on your behalf.

Preventive care is not immune.

With preventive care, dentistry as a whole tends to over-treat because, after all, “insurance will pay for it.” Big Deal, We took better care of them than they needed, who cares, we all win, blah blah. When someone feels entitled to an insurance benefit because, by George, it needs to be worth SOMETHING for all those dollars, that’s when you’ll agree when your hygienist says “see you in six months.” I guarantee that every hygienist has patients for whom getting their teeth cleaned every six months is complete overkill. Some people simply have nothing on their teeth to clean off. We spend most of your appointment scraping at stuff that’s not even there, despite our best efforts to find it. I’ve done it, lots of times, and it’s frustrating because the patient expects a cleaning every six months and we truly want everyone to feel like we’re helping them stay healthy.

That’s what I mean. There is no motivation to correct the situation. The insurance pays for cleanings every six months, so no one will challenge the perception that having your teeth cleaned twice a year is not necessary. Money is wasted, but to the patient, they “miss out on their free cleaning.”

This gets super abused in dental practices that are dependent upon patients who have insurance to stay in business. The more dependent, the more likely the abuse. That’s not to say that most dental practices are doing their best to stay within the standard of care, while carefully checking everyone’s insurance plans. Cleanings twice per year? Checkups twice per year? X-rays once per year? Everyone is treated the same. The six-month visit is a safety net, and both patients and clinicians accept it because of what insurance covers, not because treatment is necessary.

On the other hand, insurance dependence can also cause a dental practice to neglect your needs. The dentist is less likely to tell a patient to have X-rays every six months if their insurance doesn’t cover it, even if the person is suffering from severe dry mouth that is resulting in a lot of new problems that can be diagnosed with the help of more frequent imaging. If you need your teeth cleaned more often than what your insurance will pay for, an office may simply let that recommendation slide past. You are much less likely to get personalized care when you allow insurance coverage to dictate what gets done, and when. You’ve allowed yourself to be seen as “the person with insurance who is not going to pay for anything that it won’t cover.” Even if you don’t feel this way. It’s like a trap. Not just to patients, but to clinicians as well.

The Five Traps of Dental Insurance.

Trap #1: DMOs that bill for treatment above and beyond their negotiated rates. Dental Maintenance Organizations are the lowest tier of dental insurance. Dentists on these plans get capitations, which are small monthly payments for being on the provider list. To be profitable they need to bill out as much treatment as they can. Patients have come for second opinions (note: always get a second opinion if you’re unsure!) after visiting a DMO practice enough times for me to see a consistent trend of overcharging for excessive care; not just hundreds, but for thousands of dollars of treatment, out of pocket. If you have insurance that only lets you go to one or two clinics that have many doctors who cycle in and out of the offices, you probably have a DMO plan.

Trap #2: Missing Tooth Clauses. Sometimes having a tooth removed is the least expensive way to get out of pain. If you’ve ever lost a tooth, unless you had your existing insurance in place, the replacement of that tooth in the future won’t get covered. So much for getting your teeth back to working order. To the insurance company, a missing tooth is considered a pre-existing condition, so it’s your responsibility, not theirs.

Trap #3: Waiting Periods. Now you have insurance, but you’ll have to wait six months to a year to pay into the system before it might give you that money back, plus a little more? Individual dental insurance plans are notorious for waiting periods.

Trap #4: Major treatment. We’ve already established that less expensive the dental service, the more likely your insurance is to cover it. What about the expensive stuff? If it costs more than $300 per tooth or section, then your insurance will most likely only cover half of that. Ever. End of story. Need dentures? A crown? A wisdom tooth removed? You’ll have to pay at least half the bill, if not more, even if you followed the rules and went to the dentist on your plan.

Trap #5: Discount dental plans. There’s one type of discount plan you should run, run, run away from – those are the referral services. They’re not really even discount plans if the truth must be told. You pay a fee to a third party. That third party gets to keep some of your money, and in return you receive a list of dentists who will “accept” a reduced cost for a few treatments. In the meantime, the third party often encourages the dentists on their list to compensate for their reduced fees by billing for services not bound by the discount plan. I would be cautious of any dentist who uses this method to find new patients.

There would be no game of chess if the pawns refused to play.

So how do we encourage good people to stop doing bad things because of dental insurance? There’s only one way: Stop the flow of money! Have a crappy dental plan? Don’t allow your money to fund it. And if insurance abusers have no patients, they’ll eventually stop the bad behaviors.

You’d be surprised how many dentists out there would be thrilled if even half their patients decided to do everything they could to save money. The reason most dentists got into the profession? They love knowing that they’re helping people. And if the main reason you go to the dentist is to save money in the long run, they will be pleased that you chose them to partner with you to work towards that goal.

You can afford to go to the best dentists in town.

What if you could always visit the absolute best dentists, the ones that you thought only the most wealthy people visit, and you would get better and cheaper care there?

You can, and you should. The best dentist is the best, not because they cost the most, but most of the time, because they cost what you decide they cost. The best dentists have built something very important in the community that brings many people to see them.

This is where the biggest, most powerful word in dentistry comes in.

Trust.

That word goes both ways. Too many dentists don’t trust their patients to make good choices about their teeth, so they often only present one option. This is it, period. This is what your mouth needs, like it or don’t, but this is what you need, and what it costs, and this is just what we do around here and how we do it.

Instead, a good dentist will listen to the people they serve carefully, and trusts that the patient will share enough about their concerns to be able to formulate several options, not just a single option, especially for more complex care. If the financial burden even to get someone out of pain is too much, the “best dentist” is still the best value for an honest opinion. Think of them as the gatekeeper, the one who knows which dentists in your neighborhood to steer clear of, the ones who do not seem to value trust.

But they don’t take my insurance.

Seriously, you came through all of this with me, and you’re still stuck on insurance? Do you want dentists to treat your insurance, or do you want them to treat you? A good dentist’s goal is to put you in charge of your own care, and follow your values as much as possible, which is how you’ll truly end up saving money.

Should I keep using my insurance?

Should I keep using my insurance?

Sure! If you’re lucky enough to have even minimal dental insurance and you trust the practice where you’re already a patient, there’s no compelling reason to make a change just because you’re not happy with your plan. If not, it may be time to find a real dental home, one that will do honest work for honest pay, and not play games with your health, your money, and your insurance company’s money.

What is the best dental insurance?

You are fortunate if your dental insurance policy has just one or more of the following features:

- You pay nothing extra per month for your dental plan.

- You can go to any dentist you want.

- You have no maximum dollar limit.

- Major services are paid for at 80%.

If none of these apply, then your insurance probably costs you more than you receive from it. My suggestion would be to opt-out of your dental plan and let yourself get paid a little more per month instead. Then if you simply must be on a plan, many dentists offer their own form of in-house insurance, where you pre-pay for your preventive care each year, and in return you get a percentage discount for any other services you’ll need. It’s sort of like a twice-yearly gym membership, with reduced pricing for personal training sessions.

I still wish someone else would pay for my teeth.

Me too! Wouldn’t that be great? But there came a point in my life where my parent’s money stopped being my dental insurance. I had to accept that my teeth were my responsibility and that I would have to find a way to help them stay as natural as possible. Even with a career working daily in a dental practice, I’ve always had to pay out of pocket for the level of dental care that I value. One cleaning, checkup, and set of X-rays per year costs about $150 in my area, which isn’t worth jumping through insurance hoops for.

In the meantime, if you don’t have someone else paying for your teeth (like a rich relative or a great insurance plan), go to the best dentist you can find, explain that you’re done with “what insurance will cover” and ask them to treat you like a human being instead. You might just be surprised at the quality of care you receive for the cost.

And none of us, on either side of the equation, will miss the dental insurance game, not one bit.

Should I keep using my insurance?

Should I keep using my insurance?